39 Form 1023 Ez Eligibility Worksheet

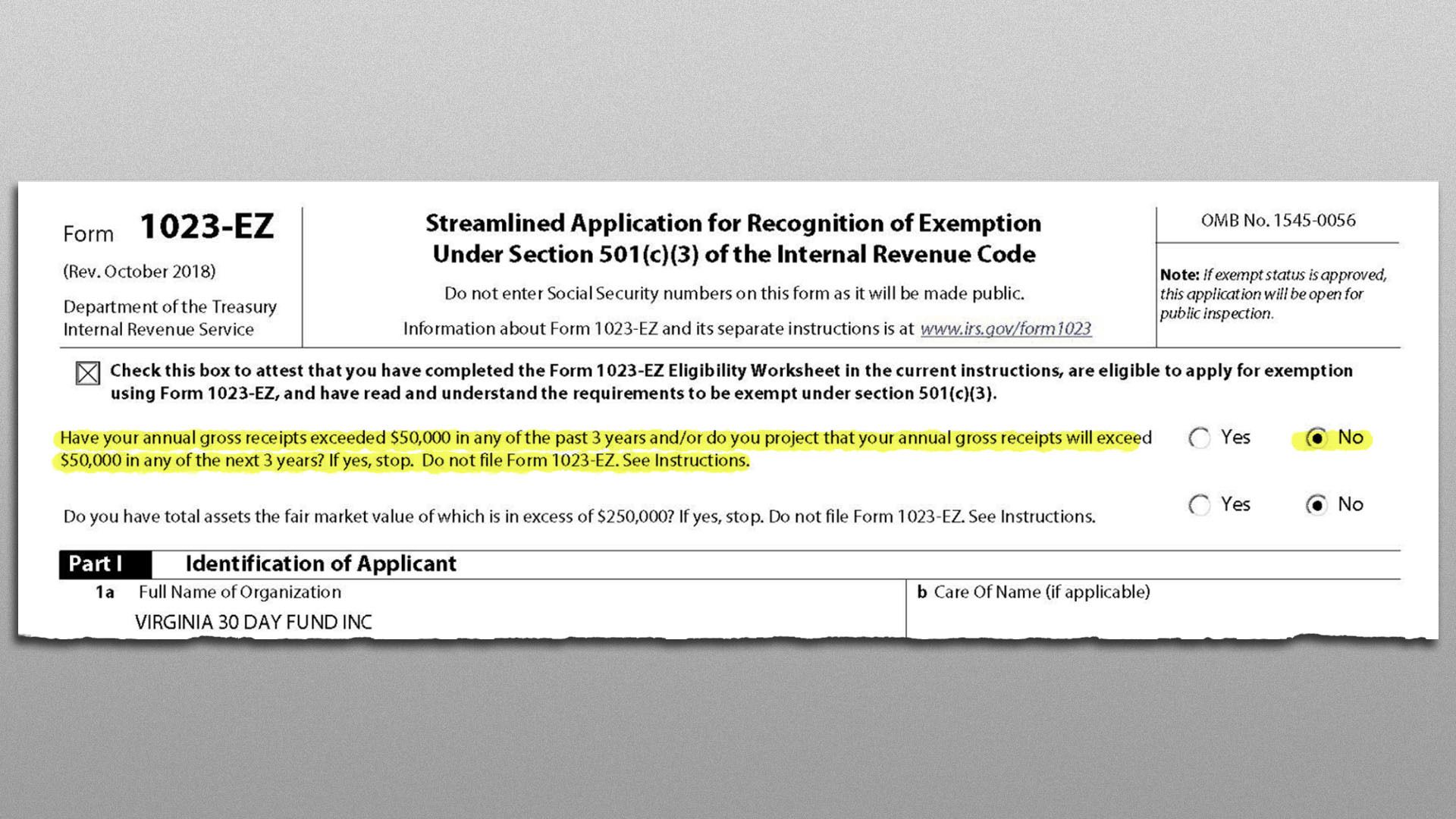

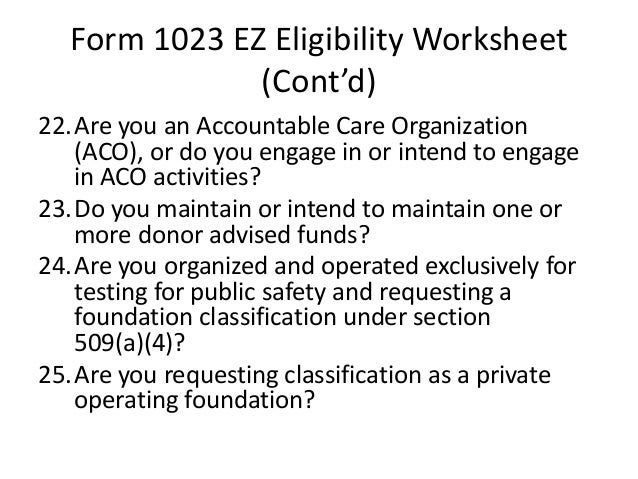

IRS Form 1023-EZ - Too Easy? - DuPage County Bar Association 1023-EZ Caveats With such drastically reduced information required, a shorter processing time, and a lower filing fee, why wouldn't everyone use Form Financials The first question on the 1023-EZ Eligibility Worksheet4 asks if your gross receipts for the next three years will exceed $50,000. Form 1023-EZ: Understanding Your Eligibility | Harbor Compliance The Eligibility Worksheet is straightforward; if you mark "Yes" on any question, your organization is not eligible to file 1023-EZ. Failure to disclose information truthfully on Form 1023-EZ and the Eligibility Worksheet can lead to your application's being rejected, later revocation of your organization's...

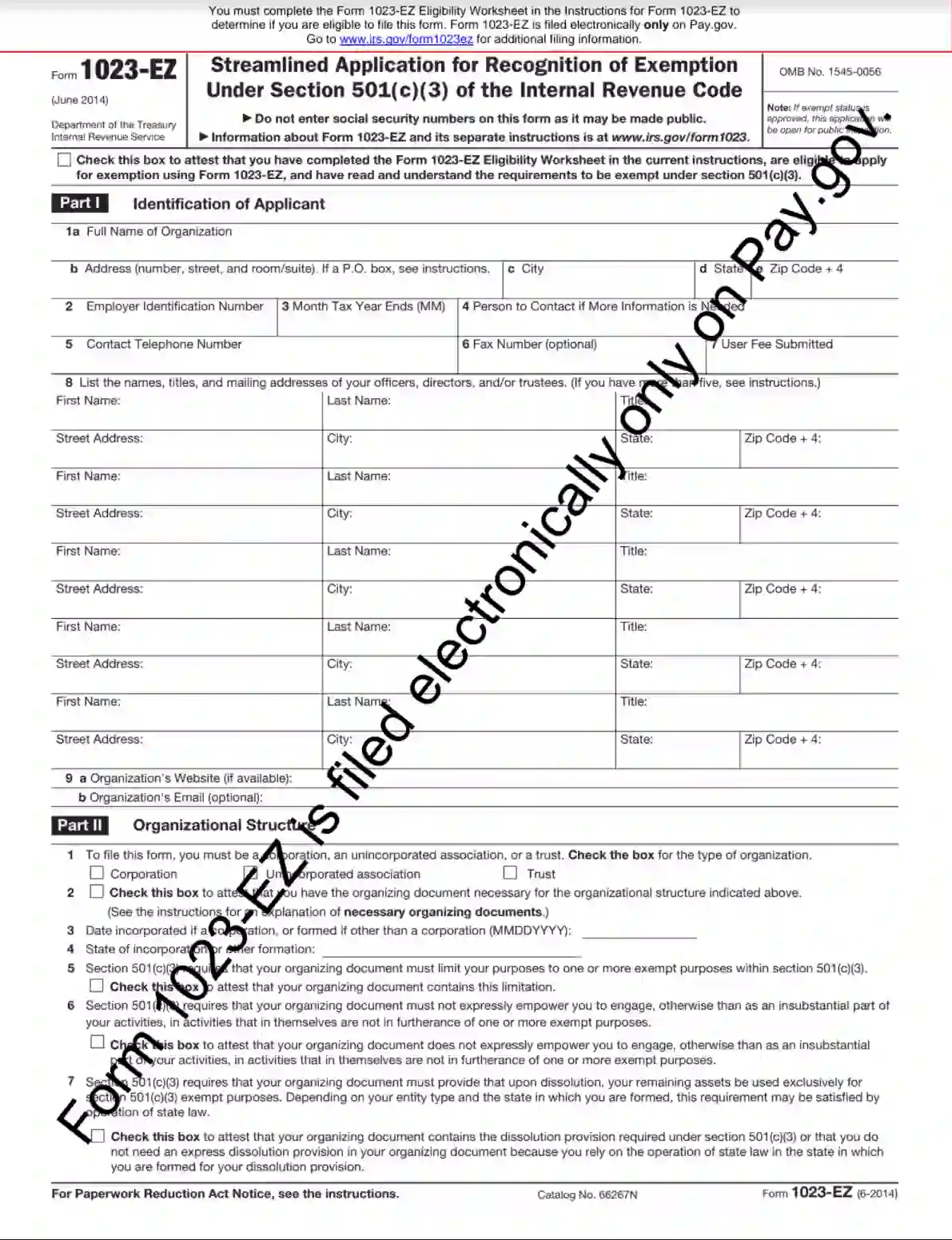

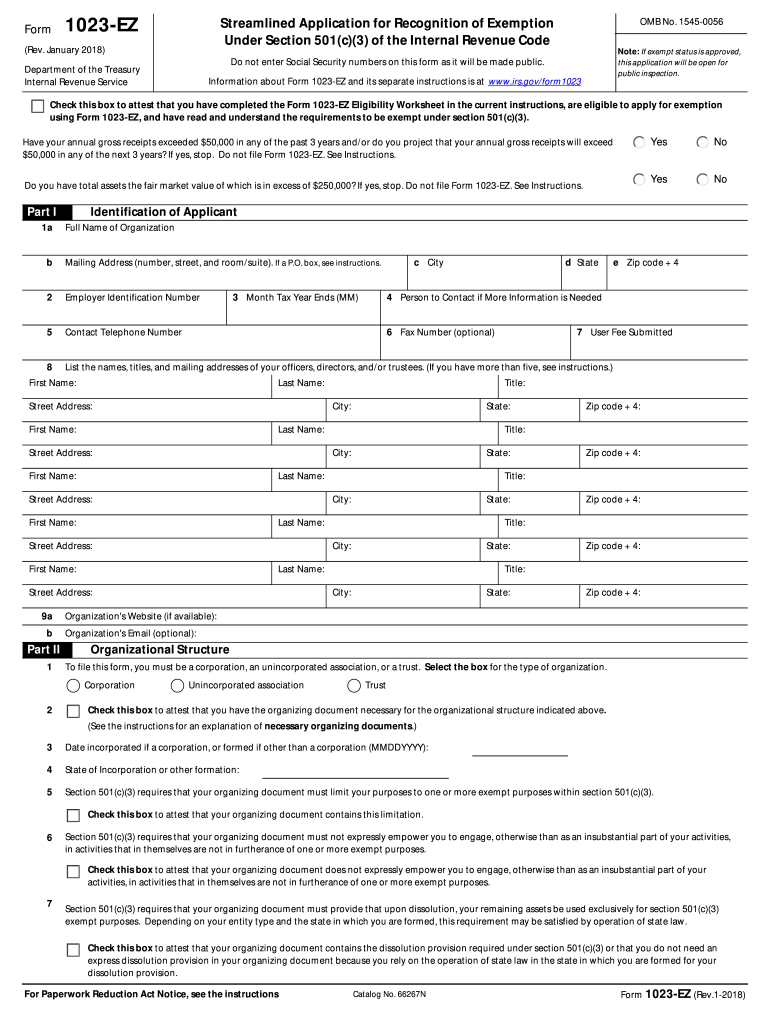

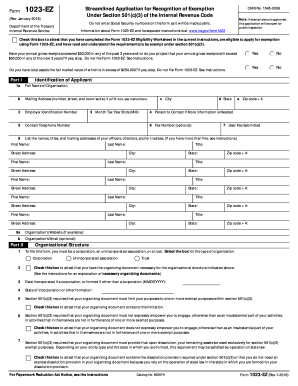

Complete the Form 1023-EZ Eligibility Worksheet To do this, complete the Form 1023-EZ Eligibility Worksheet located on pages 13 through 20 of the IRS' official Instructions for Form 1023-EZ. Before you begin filling out Form 1023-EZ, you should gather all the information you'll need in one place. Form 1023-EZ includes six sections that require...

Form 1023 ez eligibility worksheet

PDF Form 1023-EZ Eligibility Worksheet Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ). If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. Should Your Charity Submit IRS Form 1023-EZ? Form 1023-EZ is a short version of Form 1023 designed for smaller nonprofits, and it can only be filed online at Pay.gov . As part of its instructions for Form 1023-EZ, the IRS provides an eligibility worksheet to help applicants determine if their nonprofit qualifies to file Form 1023-EZ. PDF Form 1023-EZ (June 2014) Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ). If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ.

Form 1023 ez eligibility worksheet. PDF Microsoft Word - Instructions for Form 1023EZ.docx Instructions for Form 1023-EZ. (Rev. August 2015). Below are abbreviated instructions on applying for tax exempt status as a 501 c 3. For full instructions visit. To determine if you are eligible to file Form 1023-EZ, you must complete the Form 1023-EZ Eligibility Worksheet. PDF Instructions for Form 1023-EZ (Rev. January 2018) Form 1023-EZ is the streamlined version of Form 1023, Application for Recognition of Exemption Under Section 501(c) (3) of the Internal Revenue Code. Also see questions 12 through 14 on the Form 1023-EZ Eligibility Worksheet. If you are seeking recognition as a church, school, or hospital... All About IRS Form 1023-EZ - SmartAsset Form 1023-EZ is a three-page form (compared to the 12-page document and the eight schedules that go along with Form 1023). Best of all, you can file IRS Form 1023-EZ electronically. If you haven't done it already, don't forget to complete the Form 1023-EZ Eligibility Worksheet (although you don't... Form 1023-EZ - Edit, Fill, Sign Online | Handypdf Form 1023-EZ. (June 2014). Streamlined Application for Recognition of Exemption. be open for public inspection. Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply.

IRS Form 1023-EZ Application for 501... | Hurwit & Associates Form 1023-EZ is a new, streamlined, online form created by the IRS for smaller organizations that wish to apply for federal tax-exempt There are many other qualifications and any organization that wishes to file the Form 1023-EZ must complete the eligibility worksheet before submitting the form online. Starting a Nonprofit: Form 1023 or Form 1023-EZ? - Nonprofit Law Blog While Form 1023-EZ has since become the more popular application form, it may not always be the most beneficial to a nonprofit. The Instructions for Form 1023-EZ provide an eligibility worksheet starting on page 11. Form 1023-EZ Streamlined Application for Reinstatement of... If the Form 1023-EZ is accepted, the IRS will issue a letter indicating the status has been reinstated, either retroactively or effective the date of the application (depending on The first step of the form is to check the box to attest that the Form 1023-EZ Eligibility Worksheet was completed, the PTA is... How to Fill Out Form 1023 & Form 1023-EZ for Nonprofits | Step by Step Differences between Form 1023 and Form 1023-EZ. How to Fill Out Forms 1023 & 1023-EZ. How Long is the Review Process. Fees to File. Before looking at the form instructions, you must complete the eligibility worksheet to see if your organization qualifies to use Form 1023-EZ.

Pay.gov - Streamlined Application for Recognition of Exemption Under... Note: You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file Form See the Instructions for Form 1023-EZ for help in completing this application.The organization must have an Employer Identification Number (EIN)... Form 1023-EZ Eligibility Worksheet - 501c3GO Form 1023-EZ Eligibility Worksheet. Question No. 1 basically limits you to $50,000 of nonprofit income from all sources (donations, grants, gifts in kind If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. Form 1023-EZ: Less Work Now, More Work Later? - Clark Nuber PS Since the release of the Form 1023-EZ, however, practitioners have noticed a large number of determinations issued, indicating that the However, in order to qualify for the 1023-EZ, an applicant must complete an eligibility "worksheet." Calling it a worksheet is somewhat deceiving because the... Form 1023 Ez Eligibility Worksheet - Fill Out and Sign... | signNow 1023 Ez Eligibility Worksheet. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. Get everything done in minutes.

IRS Form 1023-EZ Fill Out Printable PDF Forms Online The new type of form 1023-EZ works best with the vetted full one, a procedure the IRS is responsible for. It also provides extra protection to the company and To embrace accuracy and confirm the legal effect of the paper, use the form-building software we provide on our website. Eligibility Worksheet.

Form 1023-EZ not as EZ The IRS Form 1023-EZ Streamlined Application for Recognition of Tax Exemption had previously been very straightforward, with the statutory requirements Those topics are still covered in the eligibility worksheet, but the new Form 1023-EZ highlights these eligibility determinations as part of the...

Form 1023 Ez Eligibility Worksheet 2020-2022... | US Legal Forms More Multi-State Forms. ... Form 1023 Ez Eligibility Worksheet 2020. Are you still seeking a fast and convenient tool to complete Form 1023 Ez Eligibility Worksheet at a reasonable price?

Form 1023-ez • Eligibility and How to apply » Applications in United... The IRS created Form 1023-ez, with the same purpose of Form 1023, but only for certain sorts of non-profit organizations; and it is easier to complete. These are the general conditions, but the complete list is available in the Form 1023-ez Eligibility Worksheet issued by the IRS to determine which...

Everything You Need to Know About the Form 1023 EZ 1023 vs 1023-EZ. Eligibility Worksheet. Part 1: Identification of Applicant. Part 2: Organizational Structure. Form 1023-EZ: This form is only three pages long and costs $275 to file. While this is an excellent option, in order to qualify, your organization must fit a number of specific criteria (more on...

PDF 501-EZ-eligibility-worksheet.pdf ÅÈà ¸·¹º- ¿½¿¸¿Â¿ÊÏ ÅÈÁɾ»»Ê º ËÉÊ ¸» ¹ÅÃÆ»ʻº ÆÈ¿ÅÈ ÊÅ ¹ÅÃÆ»ʿĽ ÅÈà ¸·¹º- ». ¼ ÏÅË ·ÄÉÍ»È ¡ »É¢ ÊÅ ·ÄÏ Å¼ ʾ» ÍÅÈÁɾ»»Ê ÇË»ÉÊ¿ÅÄÉ' ÏÅË ·È» ÄÅÊ »Â¿½¿¸Â» ÊÅ ·ÆÆÂÏ ¼ÅÈ »Î»ÃÆÊ¿ÅÄ Ëĺ»È É»¹Ê¿ÅÄ ¼·¸º¹»ºº» ËɿĽ ÅÈà ¸·¹º- " ÅË ÃËÉÊ ·ÆÆÂÏ ÅÄ ÅÈà ¸·¹º" ¼ ÏÅË...

Who Is Eligible to Use IRS Form 1023-EZ? | Nolo The 1023-EZ is shorter and easier to complete. By comparison, the long-form 1023 is 12 pages and includes eight sections. To determine whether your organization is eligible to use the streamlined application, you can use the 1023-EZ eligibility worksheet .

IRS Form 1023-EZ Eligibility Worksheet - Nonprofit Corporations... IRS Form 1023-EZ Eligibility WorksheetRichard Keyt2020-03-07T09:04:08-07:00. An organization that seeks to be a tax-exempt charity under Section 501(c)(3) of the Internal Revenue Code must apply for tax exempt status by preparing and filing with the IRS one of the following two IRS forms

1023 ez eligibility worksheet | PDFfiller Fillable Form 1023-ez. Collection of most popular forms in a given sphere. You must complete the form 1023ez eligibility worksheet in the instructions for form 1023ez todetermine if you are eligible to file this form. form 1023ez is filed electronically only on pay.gov.go to .irs.gov/form1023ez for...

PDF Microsoft Word - Form 1023-EZ Instructions sent to TFP on 2-10-14 Form 1023-EZ Instructions. DRAFT 2/10/14. Overview of Section 501(c)(3) Organizations. NOTE: You must complete the eligibility worksheet on page x of these instructions before completing Form 1023-EZ. You are not required to submit the eligibility worksheet with your form.

Tax Exempt Form - Fill Out Online PDF Template form 1023 ez eligibility worksheet. Form 1023EZ cannot be used if the organization estimates that its annualgross receipts will exceed 50000 in year 3. Use Form 1023 instead.httpswww.irs.govpubirspdf...

IRS 1023-EZ 2022 Form - Printable Blank PDF Online IRS 1023-EZ 2022 1023 Ez. Choose online fillable blanks in PDF and add your signature electronically....Instructions and Help about IRS 1023-EZ 2022 Form. Hi I'm Alexis and I work for the Internal Revenue Service it's...irs form 1023-ez instructions. 1023 ez eligibility worksheet pdf.

PDF Form 1023-EZ (June 2014) Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ). If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ.

Should Your Charity Submit IRS Form 1023-EZ? Form 1023-EZ is a short version of Form 1023 designed for smaller nonprofits, and it can only be filed online at Pay.gov . As part of its instructions for Form 1023-EZ, the IRS provides an eligibility worksheet to help applicants determine if their nonprofit qualifies to file Form 1023-EZ.

PDF Form 1023-EZ Eligibility Worksheet Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ). If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ.

0 Response to "39 Form 1023 Ez Eligibility Worksheet"

Post a Comment